Some Known Incorrect Statements About Outsourced Cfo Services

Some Known Details About Vancouver Accounting Firm

Table of ContentsSome Of Tax Consultant VancouverFascination About Virtual Cfo In VancouverThe Small Business Accounting Service In Vancouver Statements7 Easy Facts About Cfo Company Vancouver Shown

Because it's their job to remain up to date with tax codes and policies, they'll be able to recommend you on exactly how much money your service requires to deposit so there aren't any type of shocks. Prior to you go nuts an audit isn't constantly negative! The dreaded "IRS audit" takes place when a service isn't submitting their taxes correctly.

When it involves preparing for any type of audit, your accountant can be your friend due to the fact that they'll save you tons of time planning for the audit. To avoid your organization from obtaining "the poor audit", here are some tips to adhere to: Submit as well as pay your taxes on time Do not improperly (or fail to remember to) file business sales and invoices Don't report personal prices as overhead Keep precise company records Know your particular business tax reporting commitments Recommended reading: The 8 The Majority Of Typical Tax Audit Causes Quick, Books After examining the basic audit as well as bookkeeping solutions, you're probably asking yourself whether it's something you can handle on your own or require to hand off to an expert.

For example, will you require to prepare regular or monthly economic reports or just quarterly as well as yearly records? One more indicate think about is economic understanding. Exists someone in your workplace that is qualified to manage important accountancy and bookkeeping solutions? If not, an accountant may be your best wager.

Accounting professionals are rather versatile as well as can be paid hourly. Additionally, if you do decide to outsource accountancy and also accounting solutions, you wouldn't be in charge of supplying advantages like you would certainly for an in-house employee. If you choose to employ an accounting professional or accountant, right here are a couple of pointers on locating the right one: Check recommendations as well as previous experience Ensure the candidate is informed in accountancy software program and also modern technology See to it the prospect is well-versed in accounting plans and also treatments Check that the prospect can clearly interact monetary terminology in words you understand Ensure the prospect is sociable and not a robot Small company owners as well as entrepreneurs commonly contract out audit as well as bookkeeping services.

Little Known Facts About Tax Accountant In Vancouver, Bc.

We compare the most effective right here: Wave vs. Zoho vs. Quick, Books Don't fail to remember to download our Financial Terms Cheat Sheet, which includes essential accountancy as well as accounting terms.

To be successful in this duty, you should have previous experience with accounting and a panache for finding numerical errors. Eventually, you will supply us with accurate measurable information on financial position, liquidity as well as capital of our company, while guaranteeing we're certified with all tax obligation regulations. Manage all bookkeeping purchases Prepare spending plan forecasts Publish financial statements in time Manage monthly, quarterly and also yearly closings Integrate accounts payable and receivable Ensure timely bank repayments Compute taxes and prepare tax go to website obligation returns Handle balance sheets as well as profit/loss declarations Report on the firm's financial health and wellness and also liquidity Audit economic purchases and also records Enhance economic information discretion and also conduct data source back-ups when needed Abide by monetary plans and regulations Work experience as an Accountant Outstanding knowledge of accounting regulations and also treatments, consisting of the Normally Accepted Accountancy Principles (GAAP) Hands-on experience with bookkeeping software application like Fresh, Books and also Quick, Books Advanced MS Excel abilities consisting of Vlookups as well as pivot tables Experience with general ledger functions Strong interest to information and also good logical abilities BSc in Accountancy, Financing or relevant level Added qualification (certified public accountant or CMA) is a plus What does an Accounting professional do? An Accounting professional looks after all monetary matters within a firm, like maintaining as well as translating monetary documents - Vancouver tax accounting company.

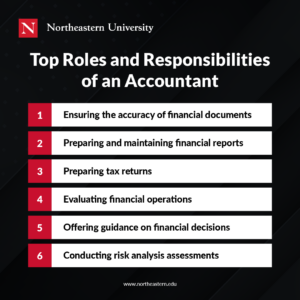

What are the responsibilities as well as obligations of an Accountant? The duties of an Accounting professional can be fairly considerable, from bookkeeping monetary papers as well as carrying out financial audits to fixing up bank declarations and also determining taxes when submitting annual returns. What makes an excellent Accounting professional? A great accountant is not just a person with financing skills but additionally a professional in human connections and interaction.

That does Accountant work with? Accounting professionals deal with business leaders in little companies or with managers in huge companies to ensure the top quality of their economic records. Accounting professionals may additionally work together with individual group leaders to recover and also audit economic records throughout the year.

Tax Accountant In Vancouver, Bc Things To Know Before You Buy

The term bookkeeping is very typical, especially throughout tax period. Prior to we dive right into the value of accounting in service, let's cover the fundamentals what is audit? Accountancy describes the methodical and also comprehensive recording of economic transactions of an organization. There are numerous kinds, from accounting for small companies, government, forensic, and also management accountancy, to accounting for companies.

Legislations and guidelines differ from one state to another, but correct bookkeeping systems and also processes will aid you ensure statutory conformity when it comes to your company (Pivot Advantage Accounting and Advisory Inc. in Vancouver). The bookkeeping function will certainly make certain that responsibilities such as sales tax, VAT, earnings tax, as well as pension plan funds, among others, are appropriately dealt with.

Company patterns and projections are based on historical economic information to maintain your operations lucrative. Services are needed to file their financial declarations with the Registrar of Firms.

How Small Business Accountant Vancouver can Save You Time, Stress, and Money.

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg)